The Velocity Portfolio

What Happens When Innovation Learns to Move at One Speed

This essay draws from the upcoming manuscript “The Enclosure of Time: Velocity, Value, and the Age of Acceleration” by Sabino Marquez (available December 2025).

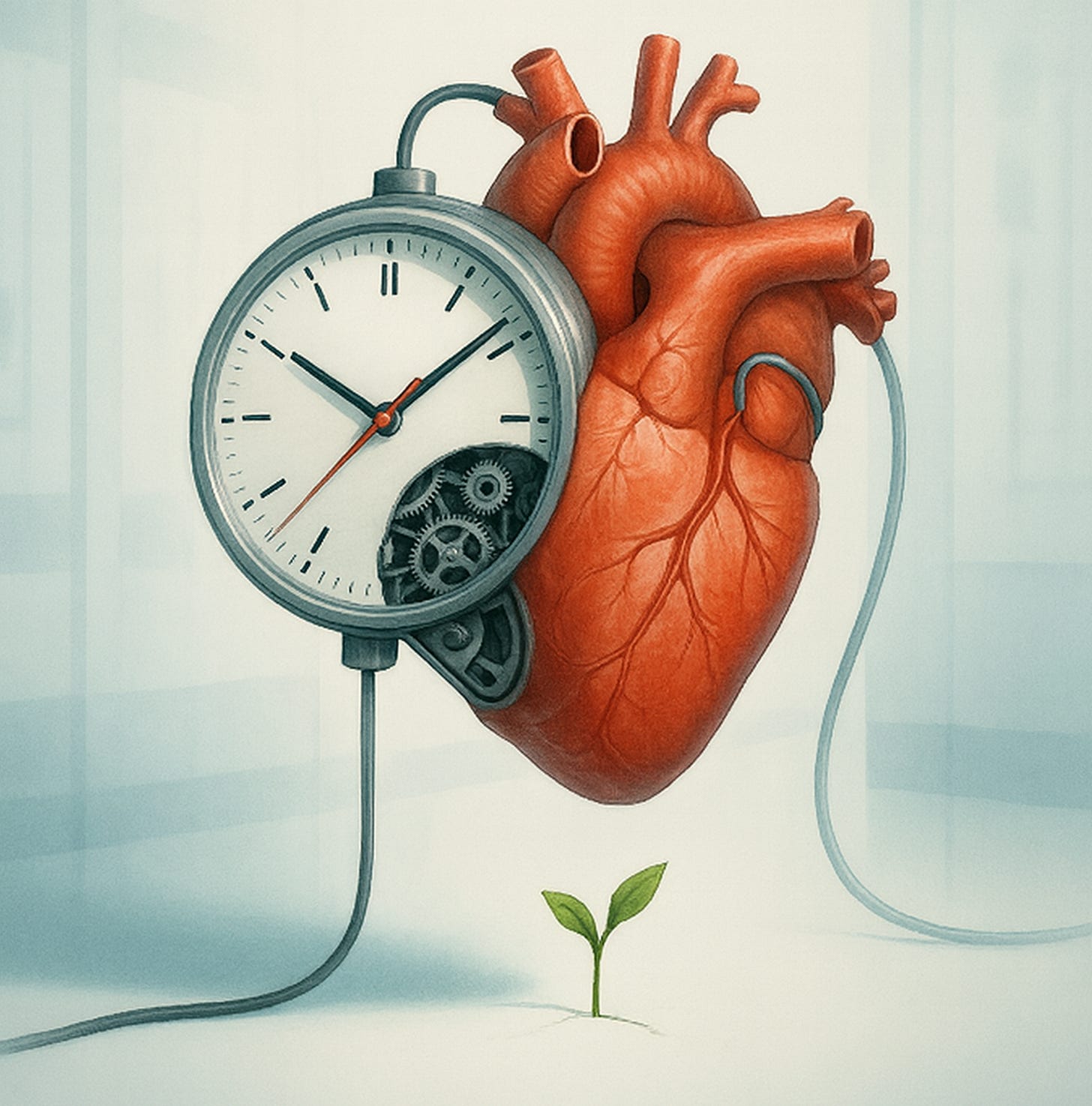

After almost two decades inside venture-backed companies, I’ve come to see that innovation isn’t simply a story about founders or technology: it’s a story about tempo. Every cycle begins with the same choreography: bright teams, early conviction, capital inflow, visible momentum. Every cycle ends the same way, with exhaustion disguised as maturity. What looks like a marketplace for imagination is closer to an institutional care system, a clinic for ideas. Each startup that enters receives a treatment plan written long before arrival. Metrics, milestones, and exit horizons come pre-formatted. None of it is malicious; all of it is structural. Venture capital has learned to manage creativity through time itself; its genius wasn’t capital leverage but temporal capture.

Inside this clinic, health means exit and recovery means liquidi…